When facing unexpected expenses or financial emergencies, many individuals turn to borrowing options such as payday loans or personal loans. While both provide quick access to funds, they differ significantly in terms of structure, repayment terms, interest rates, and overall impact on financial health. Payday loans are typically short-term, high-interest loans designed to be repaid by your next paycheck, making them appealing for urgent, small-scale needs.

In contrast, personal loans offer more flexibility, longer repayment periods, and generally lower interest rates, often making them a more manageable and sustainable option. Understanding these key differences is essential before making a borrowing decision, as the wrong choice could lead to deeper financial strain rather than providing the intended relief.

Read More: Financial Guide for the LGBTQ+ Community

Payday Loans vs. Personal Loans: An Overview

When you’re in need of extra cash, two common borrowing options are payday loans and personal loans—each serving different financial needs and circumstances. Payday loans are typically easy to access and ideal for small, short-term borrowing, especially if you’re confident in repaying the full amount by your next paycheck. In contrast, personal loans may involve a more detailed application process, but they offer access to larger sums, lower interest rates, and longer repayment periods, making them a more structured and cost-effective solution.

Both loan types share the core characteristics of borrowing: a principal amount, interest, and a repayment schedule. However, they differ significantly in key areas such as approval requirements, loan costs, repayment terms, and how lenders assess your financial purpose and ability to repay—differences that can greatly influence your overall financial well-being.

Key Takeaways

- Both payday loans and personal loans can offer quick financial relief during unexpected emergencies.

- Payday loans often carry extremely high interest rates and may include hidden fees, making them a costly option.

- Personal loans involve a formal application process but typically come with lower interest rates and longer repayment terms.

- Failing to repay a payday loan on time can lead to accumulating late fees, increasing the total amount owed and creating a cycle of debt.

- Most payday lenders do not report to credit bureaus unless the borrower defaults, which limits their impact on credit scores—unless payments are missed.

How Payday Loans Work

Payday loans are short-term, high-cost loans that are easy to access but come with serious financial risks. These unsecured loans are typically offered in small amounts and are designed to be repaid by your next paycheck. While the minimal application requirements make them appealing in emergencies, the combination of sky-high interest rates and short repayment windows can quickly trap borrowers in a cycle of debt. Due to their predatory nature, payday loans are banned or heavily restricted in 18 states and the District of Columbia.

Easy to Access, But Risky

Payday lenders generally don’t assess your ability to repay. They may request proof of income, but collateral is not required. In most cases, borrowers either write a postdated check or give the lender electronic access to their bank account to withdraw the loan amount plus fees on the due date.

Short Repayment Terms

Repayment is typically expected within two weeks or by your next paycheck. If you fail to repay on time, lenders impose steep late fees, making it even harder to get out of debt. Many borrowers end up renewing or rolling over loans, which only increases the total amount owed.

Extremely High Interest Rates

The annual percentage rate (APR) on payday loans can be shockingly high—often averaging around 400% and reaching as much as 780% in some cases. These excessive rates and fees have led many experts and regulators to classify payday loans as predatory.

State Restrictions

Due to the risks, payday loans are outright prohibited in the following jurisdictions:

- Arizona, Arkansas, Connecticut, District of Columbia, Georgia, Illinois, Maryland, Massachusetts, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Pennsylvania, South Dakota, Vermont, and West Virginia.

Some states permit payday lending with restrictions—such as limits on loan amounts or interest rates—including Colorado, Kentucky, Mississippi, and South Dakota.

In states where payday lending is legal, regulations vary. Each state sets its own rules to protect consumers, although enforcement and effectiveness can differ.

According to the Consumer Financial Protection Bureau (CFPB), most payday loans are not repaid on time, leading to a cycle of repeat borrowing and mounting debt.

How Personal Loans Work

Personal loans are a type of installment loan that can be either secured or unsecured, offering borrowers longer repayment terms and significantly lower interest rates than payday loans. Unlike payday lenders, personal loan providers carefully assess your credit history, income, and financial stability to determine your ability to repay the loan. This makes personal loans a more reliable and structured borrowing option for those who qualify.

Applying for a Personal Loan

To obtain a personal loan, you’ll need to complete an application—either in person at a bank, credit union, or other financial institution, or through an online lender. The application process involves sharing personal and financial information so the lender can evaluate your creditworthiness. If approved, the loan terms will outline the amount borrowed, the interest rate, repayment schedule, fees for late payments, and the loan’s overall duration. Once you agree to the terms, funds are typically disbursed directly into your bank account or via check, and you’re free to use the money for almost any purpose.

Secured vs. Unsecured Options

Personal loans can be secured or unsecured. Secured loans require collateral—such as a car, investments, or a certificate of deposit—which the lender can seize if you default. Unsecured loans, which are more common, don’t require collateral but often carry higher interest rates because of the increased risk to the lender.

Borrower Requirements

To qualify, lenders generally look for a minimum credit score, stable income, and a healthy debt-to-income (DTI) ratio. These criteria help lenders ensure that borrowers can manage the loan responsibly and reduce the risk of default.

Personal loans provide a more predictable and affordable way to borrow money when compared to payday loans, especially for those who meet the necessary credit and income standards.

How Do People Use Personal Loans?

Personal loans are a flexible financial tool used for a wide range of purposes. According to a national survey conducted by Investopedia between August 14 and September 15, 2023, among 962 U.S. adults who had taken out a personal loan, the most common reason for borrowing was debt consolidation. Borrowers often use personal loans to combine multiple high-interest debts—like credit cards—into a single, more manageable payment with a lower interest rate.

Other popular uses included home improvement projects, such as renovations or repairs, and large purchases like appliances, medical bills, or travel expenses. The survey also revealed that many individuals would consider using future personal loans for similar needs, emphasizing the loan’s role in helping manage both planned and unexpected expenses.

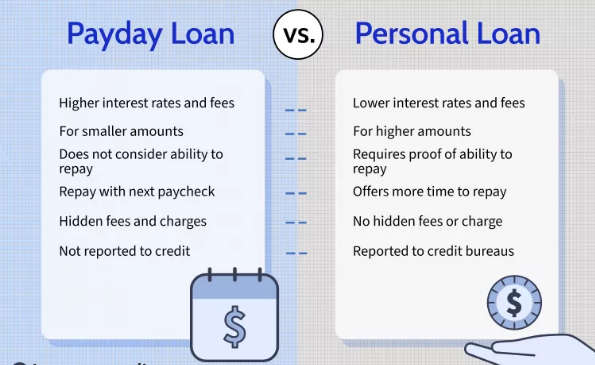

Key Differences Between Payday Loans and Personal Loans

There are several key distinctions between payday loans and personal loans that can influence your decision depending on your financial needs:

- Use:

Payday loans are typically used for small, urgent expenses—usually around $500—intended to be repaid within a couple of weeks. They are often sought for unexpected financial emergencies. In contrast, personal loans are used for larger, planned expenses such as consolidating debt, making significant purchases, or financing home repairs. They come with much longer repayment periods, offering greater flexibility. - Cost:

One of the biggest differences lies in the cost. Payday loans tend to have much higher interest rates and can burden borrowers with hidden fees and charges. Personal loans generally have lower interest rates, making them more affordable over time. - Accessibility:

Payday loans are often easier to obtain than personal loans due to minimal requirements. Some payday lenders may approve loans without the need for a bank account, as long as you have a prepaid card. Personal loans, on the other hand, typically involve more stringent qualifications, including a credit check and proof of income. - Credit Score Impact:

Most payday lenders don’t report loans to credit bureaus, so paying off a payday loan won’t improve your credit score. On the other hand, personal loans are reported to credit agencies, and making timely payments can positively impact your credit score, improving your financial standing over time.

Frequently Asked Questions

What is the main difference between payday loans and personal loans?

The primary difference is the repayment term. Payday loans are short-term loans typically due within a couple of weeks, while personal loans are installment loans with longer repayment periods. Additionally, personal loans generally offer lower interest rates and may require a credit check.

Can payday loans affect my credit score?

Most payday lenders do not report to credit bureaus. Therefore, paying off a payday loan generally does not impact your credit score, unless you default and the lender takes legal action.

What can personal loans be used for?

Personal loans are often used for larger expenses, such as debt consolidation, home improvements, major purchases, or emergency expenses. They offer more flexibility compared to payday loans.

How do I qualify for a personal loan?

To qualify for a personal loan, lenders typically look at factors like your credit score, income, and debt-to-income ratio. The application process usually involves submitting personal and financial details for evaluation.

Are payday loans easy to get?

Yes, payday loans are generally easier to obtain than personal loans because they have fewer requirements. Some payday lenders do not require a credit check or a bank account, making them accessible to a broader range of individuals.

Which loan is more expensive, payday loans or personal loans?

Payday loans are much more expensive due to their high-interest rates and hidden fees. Personal loans, on the other hand, tend to have lower interest rates and more transparent terms.

Conclusion

both payday loans and personal loans serve distinct financial purposes and come with their own set of advantages and drawbacks. Payday loans are quick, short-term solutions for urgent financial needs but come with high interest rates and fees that can lead to increased debt if not repaid on time. On the other hand, personal loans offer a more structured, affordable option for larger expenses, with lower interest rates and longer repayment terms. They require a more thorough application process but can be beneficial for improving credit scores and managing significant financial commitments.